When we trade, we always try to stack the odds in our favor, forgetting the value of time. If beginners trade with a good risk to reward ratio, then they can be right in half of their trades, which may help them to get a healthy return. They should master the skills relating to how they can create a trading plan to find the right opportunity. Some of the best opportunities in the Forex market can be found when breakouts occur. In this article, we will know about the advantages of trading with Forex breakouts and learn about the techniques to use breakouts in our favor.

Breakouts

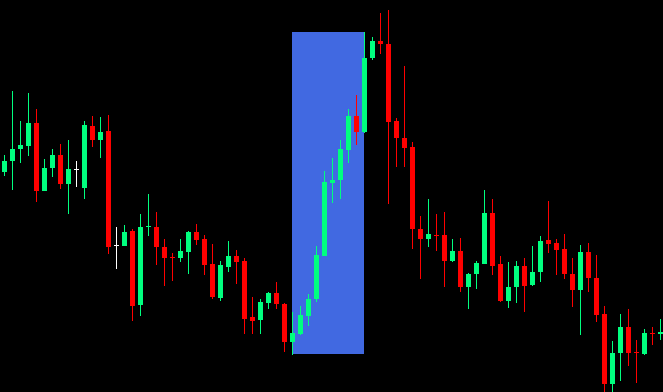

When the price of the currency pairs breaks out at a certain psychological level and overpowers the pricing behavior on a graph, we consider these as the possible breakouts. Investors may find the prices generally tend to conform and move to certain levels. These are regarded as the important clues which strengthen the level and help to anticipate the potential result from the trade.

Sometimes it can also be seen that the rate is hitting a specific level repeatedly which indicates that a particular level can be stronger than the usual at some point if the price breaks through the contained level and in such a way we get our breakout trading setup. This provides a beautiful opportunity for conducting business, and investors attempt to enter the market when they find a breakout has occurred. Visit this page and read more about breakout trading techniques at Saxo as it will help you make better decisions.

Besides, experts find the reliable breakouts on the high momentum, and using this opportunity of price action, traders in the United Kingdom try to maximize the profit margin with a rapid price move. This style of trading is regarded as one of the popular methods among the investors as they may utilize the techniques in a more versatile way.

Places of occurrence

Breakouts are the psychological pricing movements that may occur in the support or resistance level, in the trend lines, price channels, pivot points, or with the time highs or lows. This may move the price with a speedy approach because the potentiality of it can be discovered by many participants of the market. As the market spikes, the other side covers the lost position quickly by creating a sharp pricing movement.

Psychological areas

The confirmation of the price at the same level may make us realize the presence of the psychological area. Experts use the highest level and the lowest by treating the distance between these two lines as the resistance or the support area. They disregard that as a part of the psychological area when the candles of the level have a wick and move far from the expected scope of the level. We will not say it a breakout if a candlewick takes its move beyond the psychological area. If the price of the pair gets closed beyond the candle, then we can find a real one that occurred in that situation.

Finding the indicator

If beginners are not confident enough to read price action purely, then we can take the help of the additional trading indicators, and in this case, the momentum indicator can work powerfully, and this indicator is used by most traders. The momentum indicator includes a curved line and an area which show the fluctuations. If the momentum is moving downwards, then it provides the hint that the price will decrease. On the other hand, if the momentum moves upwards, then we get the indication of the increase in the price.

Therefore, to enter into an emerging market with the beginning of the price move, we have to take the breakouts as valuable indicators. If price action rules are not enough for us to measure the breakouts, then we can also use the additional indicators to research the necessary market movements.